Dear clients and friends:

The objective of this bulletin is to provide you with general information regarding compliance with some of the tax obligations that individuals have in Mexico, for the 2021 fiscal year.

As everyone knows, in accordance with the Income Tax Law (hereinafter “LISR”), individuals who are residents for tax purposes in this country and who obtain income are required to pay income tax in Mexico, among others, in cash, in goods, in credit, in services, or of any other type, obtained either in Mexico or abroad.

On the other hand, in accordance with Article 150 of the LISR, individuals who obtain income (except exempt income and on which a definitive withholding has been made) in a calendar year are required to pay annual income tax by means of a declaration that must be presented no later than April 30th of the year following that in which the aforementioned income was obtained. In the case of the 2021 fiscal year, the deadline would be April 30th, 2022, however, since it is a non-business day, the annual tax return may be submitted no later than Monday, May 2nd, 2022, based on the Federal fiscal Code.

On the other hand, it should be noted that individuals who only obtain accruable income from salaries and in general from the provision of a subordinate personal service (Chapter I, Title IV of the LISR) and interest may choose not to file an annual return (Chapter VI, Title IV of the LISR), when the sum of both does not exceed $400,000, provided that the actual interest does not exceed $100,000, and the withholding referred to in the first paragraph of Article 135 of this Law has been applied to the income

Likewise, the LISR establishes that taxpayers who have obtained total income in excess of $500,000 in the fiscal year being declared (including those for whom they are not required to pay income tax and for whom the definitive tax has been paid), must declare all their income received, including those for which they are not required to pay income tax, such as travel expenses incurred in service of the employer, the sale of a home (for the exempt part) and those received by inheritance or legacy.

As far as employees are concerned, also an annual tax return must be submitted in the following cases:

- When they obtain accruable income other than wages and interest.

- When they have had informed in writing to the withholder that an annual tax return will be filed.

- When they provide services to two or more employers simultaneously.

- Yes, they also obtained compensation or retirement income.

- When the provision of the service has begun after January 1 or ceased to be provided before December 1 of the year in question, and the sum of $400,000 is exceeded for this concept.

- When they have obtained salary income from a source of wealth located abroad or from persons not required to make the withholdings.

Individuals must file an annual tax return, among other cases, when they have obtained income in the year from:

- Business and professional activities.

- Business activities, including those who are taxed under the Tax Incorporation Regime and opted to make bimonthly provisional payments applying the profit coefficient.

- Business activities carried out only through technological platforms, computer applications or similar, which have not chosen to make final payments.

- Leasing and in general for granting the temporary use or enjoyment of real estate.

- Sale of goods.

- Acquisition of goods.

- Interests (when the actual interest has been greater than $100,000)

- Dividends.

- Interests from abroad and exchange gain.

- Dividends or profits from abroad

Individuals even if they are registered in the Tax Incorporation Regime (RIF) and have not opted to make bimonthly payments applying the profit coefficient, they do not file an annual return, since said regime the bimonthly returns that are filed during the year are considered definitive.

Personal deductions:

In accordance with Article 151 of the LISR, individuals may deduct, in addition to the deductions authorized for each of the Chapters of Title IV (corresponding to each type of income), the following concepts:

- Payments for medical and dental fees, psychology and nutrition services, medical expenses for incapacity or disability, hospital expenses, medicines included in bills for hospitalization (which are included in hospital receipts not pharmacy receipts), clinical analysis and laboratory studies, as well as the purchase or rental of devices for restoration or rehabilitation, made by the taxpayer for himself, for his spouse or for the person with whom he lives in concubinage and for his ascendants or descendants in a straight line, (provided that said persons do not receive during the calendar year income that exceeds the value of the annual Measurement and Updating Unit (UMA) equivalent to $32,693.40).

- Funeral expenses in the part in which they do not exceed the annual unit of measurement and updating (UMA) equivalent to $32,693.40.

- Donations to donees or entities authorized by the SAT, provided that all the rules indicated by the LISR are complied with.

- The real interest accrued and actually paid (determined in accordance with the LISR), generated by mortgage loans for the acquisition of a home, whose value of the credit granted must not exceed the equivalent of 750,000 Investment Units (UDIS).

- You can deduct complementary retirement contributions and voluntary contributions made directly to your subaccount, as long as they meet the permanence requirements. Contributions that will be used exclusively for use when the holder reaches the age of 65 or in cases of disability or inability to perform paid personal work in accordance with social security laws are deductible.

- Insurance premiums for medical expenses, complementary or independent of health services provided by public social security institutions, provided that the beneficiary is the taxpayer himself, his spouse or the person with whom he lives in concubinage, or his ascendants or descendants, in a straight line.

- Expenses for school transportation of descendants in a straight line when this is mandatory under the terms of the legal provisions of the area where the school is located or when said expense is included in tuition for all students. For these purposes, the corresponding amount for school transportation must be separated in the receipt.

- Payments made for local income tax on salaries and in general for the provision of a subordinate personal service, provided that the rate of said tax does not exceed 5%.

It is important to note that the total amount of personal deductions (except medical expenses for incapacity and disability, donations, voluntary contributions and complementary retirement contributions, deposits in special savings accounts and school fees) cannot exceed 5 Units of Measurement and Updating (UMA) per year equivalent to $163,467.00 or 15% of your total income, whichever is less.

It should be noted that the above limitation is not applicable to donations (section III of Article 151 of the LISR), which have their own limitation in terms of Article 151 of the LISR (the limit to deduct donations is considering the cumulative income of the immediately preceding fiscal year, up to 7% for those granted to authorized donees and up to 4% for those granted to the Federation).

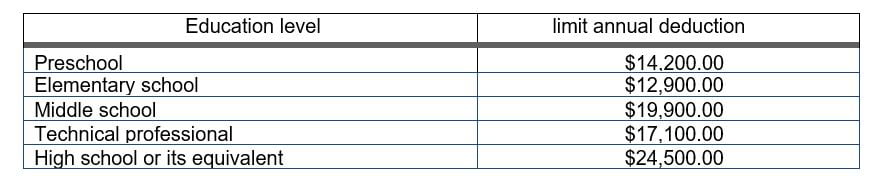

In addition to the foregoing, the payments for tuition fees for basic and high school education, made by the taxpayer for himself, for his spouse and for his ascendants and descendants (as long as such persons do not receive income during the calendar year that exceeds the value of the annual Measurement and Updating Unit (UMA) equivalent to $32,693.40). The deductible amounts are the following:

Educational institutions must separate in the tax receipt the amount for education (tuition) and in addition to all tax requirements, include the student’s CURP.

In addition, the purchase of prescription optical lenses to correct visual defects may be deducted, up to an amount of $2,500 in the fiscal year (of the taxpayer, his/her spouse and their economic dependents, ascendants and descendants in a straight line).

It is important to note that, except for funeral expenses, donations, real interest paid on mortgage loans for homes, complementary retirement contributions and local taxes on salaries, the rest of the personal deductions must have been paid electronically, that is, with the taxpayer’s nominative check, electronic transfer of funds, from accounts opened in the name of the taxpayer in institutions that make up the financial system and the entities that the Bank of Mexico authorizes for this purpose, or by means of a credit, debit or services card.

Some of the requirements to file the annual tax return

Employees, dividends and interest

They must have:

- Constancy of withholdings and perceptions.

- Invoices and receipts for deductible personal expenses.

- Federal Taxpayer Registry Key (RFC) and Unique Population Registry Key (CURP).

- Confidential Electronic Identification Key (Password, formerly CIEC).

- And in case of having a favorable balance, the Standardized Bank Key (CLABE) and, if it is equal to or greater than $10,000, the e.signature (previously Advanced Electronic Signature) to request the automatic refund (the automatic refund does not apply when income is obtained from co-ownership, marital partnership or succession, or when the balance in favor is greater than $150,000, and in such cases the return process must be carried out through the SAT page).

Business activities, tenants and professional services

In addition to what is indicated for salaried employees, you must have:

- Documentation related to the deductions that they have made on their activities (and that were essential for their activity).

- A book of expenses and income.

- Declarations of provisional payments of income tax and definitive monthly VAT declarations, already submitted.

- Work papers with which the monthly payments of the value added tax were calculated.

It is important to remember that in the case of tenants, there is the option of deducting 35% of the income obtained from the lease (optional or “blind” deduction), in substitution of the deductions established in Article 115 of the LISR (which comply with requirements established by the LISR), except for the case of the property tax of said properties corresponding to the calendar year or the period during which the income was obtained in the fiscal year, as appropriate, which may also be deductible with this option

In the case of subletting, only the amount of rent paid by the lessee to the lessor will be deducted.

With regard to interest and exchange gain from deposits made abroad, the nominal interest will be accumulated, and the calculation of the annual adjustment for inflation must be made, without considering the debts, to determine the accruable interest or deductible loss. As an alternative, the cumulative amount may be determined by applying to the amount of the deposit or investment at the beginning of the year, the factor published by the SAT in the Official Gazette of the Federation, which is 0.0000 for 2021. The foregoing must be declared in Section of the other income obtained by individuals.

It should be noted that individuals residing in Mexico must report loans, donations and prizes obtained during the year in their annual tax return, provided that these individually or jointly exceed $600,000. Likewise, inheritances, legacies and disposals of homes must be reported, provided that the total sum is greater than $500,000.

Tools and facilities that the SAT presents for the 2021 annual declaration

In order to facilitate compliance with tax obligations, the Tax Administration Service (SAT) made available to taxpayers some tools to prepare the annual tax return of individuals 2021, such as the SAT ID tool, which allows you to generate or renew the password and renew the electronic signature (e.firma), if it has an expiration date of less than one year, without leaving home and from any device with internet access. Additionally, there are other support tools for the correct fulfillment of this obligation, such as the payroll viewer for the worker, the viewer of invoices issued and received, and the viewer of personal deductions.

Another of the facilities mentioned by the SAT is for individuals who obtained salary income from an employer and who are not required to file the annual return, but who, however, do have personal deductions that may result in a favorable balance, you can present it no later than July 31st, 2022, to obtain your refund automatically.

As always, we are at your service for any clarification, doubt or support you may require in order to correctly comply with your tax obligations.

The purpose of this bulletin is to inform about the most important publications on tax matters, without it intending to present the opinion of our Firm on the aspects discussed; each case must be carefully analyzed to conclude on the correct interpretation of the provisions discussed here.